The Financial Conduct Authority (FCA) regulates UK financial services. The FCA safeguards consumers, market integrity, and industry stability. New regulations will take effect on July 31, 2023, to protect vulnerable customers. This blog article discusses how Financial Services firms can comply with these new laws.

What is a vulnerable consumer

The FCA defines a vulnerable consumer as “Someone who due to their personal circumstances is particularly susceptible to harm, particularly when a firm is not acting with appropriate levels of care.” (FCA, 2021:1) Anyone can find themselves in vulnerable circumstances, at any time. This can result in a person having different needs and behavioral biases that can impact their decision making, and they might not be able to protect their own interests as well as others. With this new FCA regulation companies and their employees are legally mandated to recognise and respond to the needs of consumers, if someone is in a vulnerable state particular care should be taken to ensure they are treated fairly.

What does this mean for companies

The FCA has developed a Vulnerable Consumer Strategy that provides guidance for companies on how they can approach this mandate, click here for the full report. Here is a quick dive into the key areas:

Identifying a vulnerable consumer: Understand the nature of any potential vulnerabilities within your customer base. What potential disadvantages do your customers face, and how does this impact outcomes, and consumer experiences?

Review and update your processes: Ensure that your processes and systems provide your employees with the resources and tools necessary to assist vulnerable customers in disclosing their requirements and providing appropriate customer service. The FCA Handbook provides guidance on what actions should be taken in order to ensure the fair treatment of vulnerable consumers. This includes areas such as affordability assessments, debt management, and complaints handling.

Employee enablement: Ensure your frontline employees are equipped with the knowledge, skills, capabilities and support to be able to communicate and respond to someone who might be deemed as vulnerable.

Communication: Ensure all information on products and service offerings can be understood by your customer base. Multiple communication channels should be offered so vulnerable consumers have a choice in how they communicate.

Monitoring – Determine when processes should be evaluated to ensure the needs of vulnerable consumers are being met, what’s working well and what needs further consideration.

How can Financial Cloud help

Companies can expect to be asked by the FCA how their business model, company culture and processes ensures the fair treatment of vulnerable consumers. The Financial Cloud CRM platform enables our customers to:

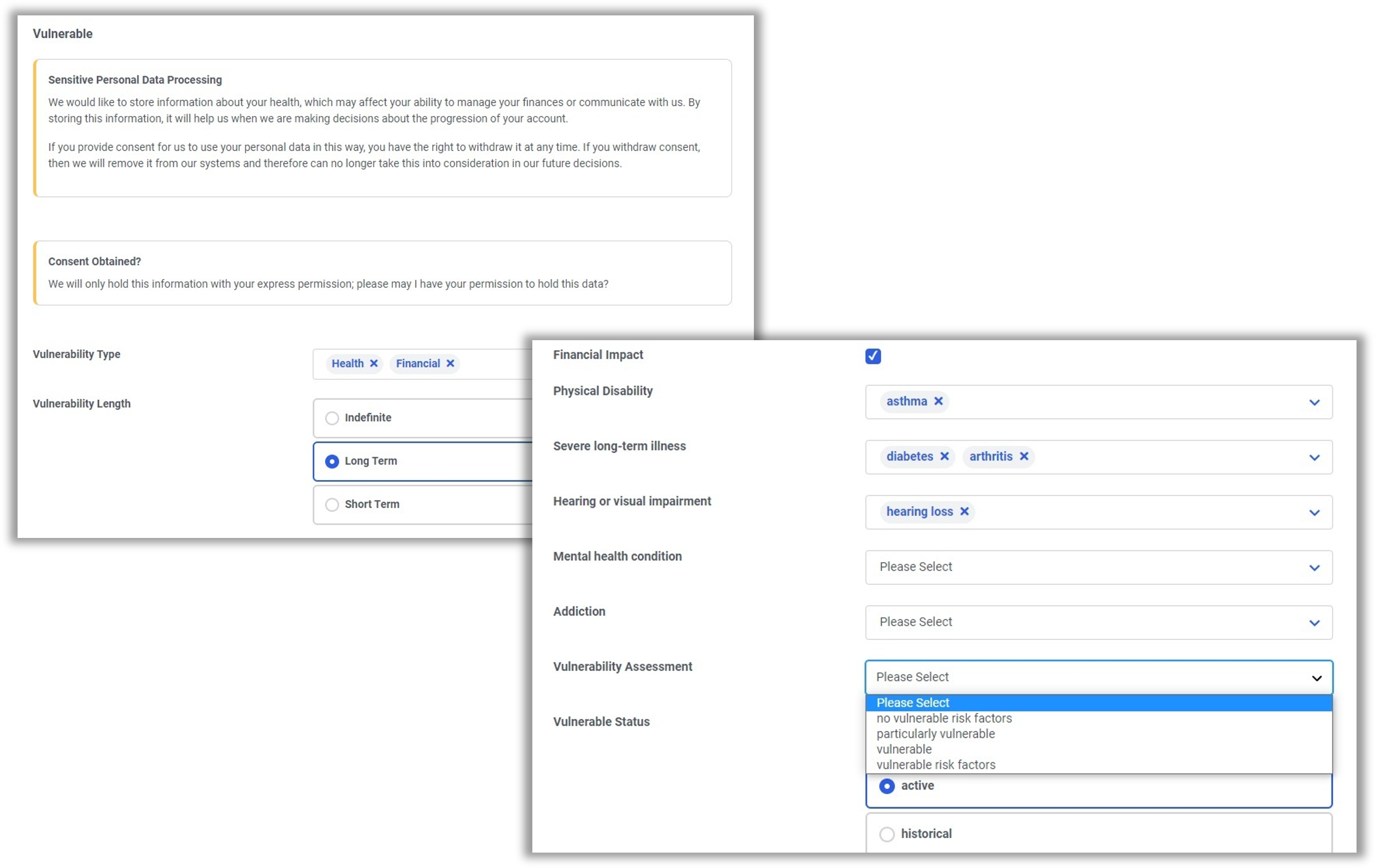

Conduct a vulnerability assessment to identify the nature of a person's vulnerabilities and assess the potential impact on their current circumstances. These assessment forms are fully dynamic, enabling organisations to effortlessly integrate their unique compliance requirements into the system.

Set up custom rules using our real-time logic engine to automatically sequence a series of connected events based on specific conditions, allowing the CRM to execute the pre-defined course of action on the customer account. For example, if a customer is identified as “low risk” the action could be to provide 30-days breathing space, communications can be sent, tasks can be added to dashboards for agents, and the status and reason code will be updated.

Communicate the details to the customer with tailor-made letter and email templates informing them of the 30-day breathing space.

Set-up a vulnerability review as a strategy to automatically handle communications and customer lifecycle changes. Financial Cloud will flag the customer is ready to be contacted for a vulnerability review and implement effective strategic adjustments in response to the change in circumstances after the 30-day period.

The Financial Cloud CRM can be easily configured by our customers, enabling flexibility, scalability and the ability to adapt as new regulations are introduced. To find out more about our CRM platform visit our website..

**FCA (2021) FG21/1: Guidance for firms on the fair treatment of vulnerable customers (fca.org.uk)